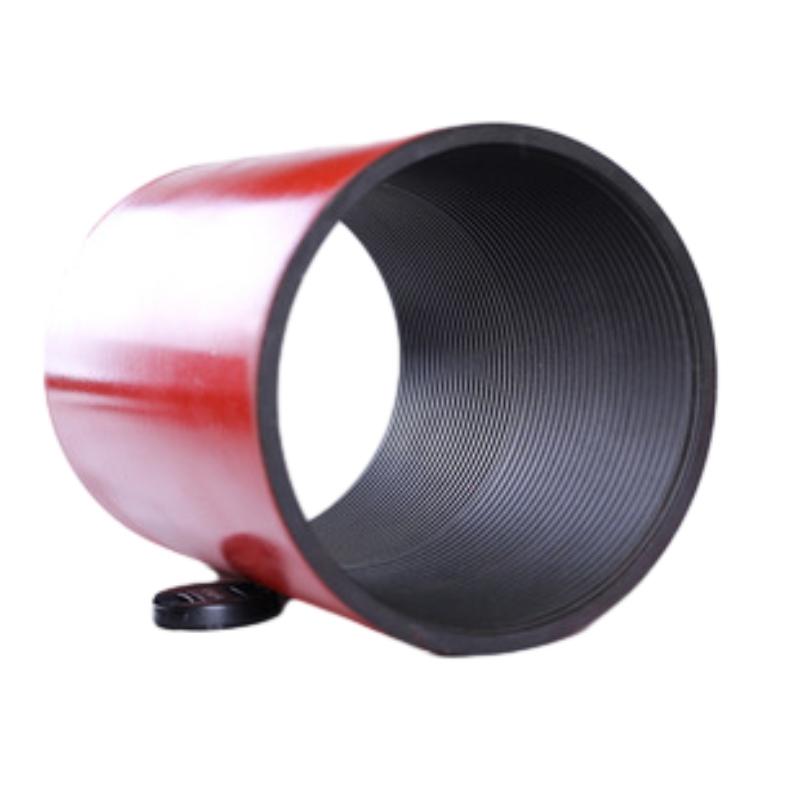

5 16 union coupling

Understanding 5% Union Coupling A Key Concept in Financial Derivatives

In the world of financial derivatives, the concept of coupling has gained prominence, especially with the advent of innovative financial products designed to meet the diverse needs of investors. One such development is the 5% union coupling, a term that denotes a specific financial strategy or mechanism applied in union situations, often aimed at optimizing returns and managing risks.

Understanding 5% Union Coupling A Key Concept in Financial Derivatives

The advantages of employing a 5% union coupling strategy are manifold. For instance, it provides investors with a sense of security, offering a predictable minimum return in an otherwise volatile market. This is particularly appealing during economic downturns when traditional investment avenues may yield lower returns. Furthermore, this approach promotes diversification, allowing investors to spread risk across various assets while still aiming for a consolidated return.

5 16 union coupling

Implementing a 5% union coupling requires careful planning and execution. Financial institutions typically work closely with regulators to ensure compliance with existing laws and standards, creating a transparent and accountable environment for all participants. Additionally, robust risk management frameworks must be established to monitor market conditions continuously and adjust strategies accordingly.

However, investors must also be aware of the inherent risks associated with such couplings. While a minimum return of 5% is enticing, it does not eliminate the potential for losses if market conditions worsen unexpectedly. Therefore, thorough due diligence and a comprehensive understanding of the associated financial products are essential before engaging in these types of investments.

In summary, the 5% union coupling serves as an innovative financial strategy that enables investors to pursue stable returns while navigating the complexities of the financial markets. By fostering collaboration among different investment vehicles and adhering to sound risk management practices, this approach not only protects capital but also potentially enhances overall portfolio performance. As the financial landscape continues to evolve, strategies like the 5% union coupling will likely play a crucial role in shaping the future of investing.

-

Unlock the Benefits of Pup Joints for Your OperationsNewsOct.31,2024

-

The Quality of Casing Couplings from ChinaNewsOct.31,2024

-

The Essential Role of Pup Joints in Drilling OperationsNewsOct.31,2024

-

The Benefits of Tubing Couplings for Your ProjectsNewsOct.31,2024

-

Enhance Your Drilling Operations with Tubing Pup JointsNewsOct.31,2024

-

Elevate Your Drilling Operations with Tubing CrossoversNewsOct.31,2024