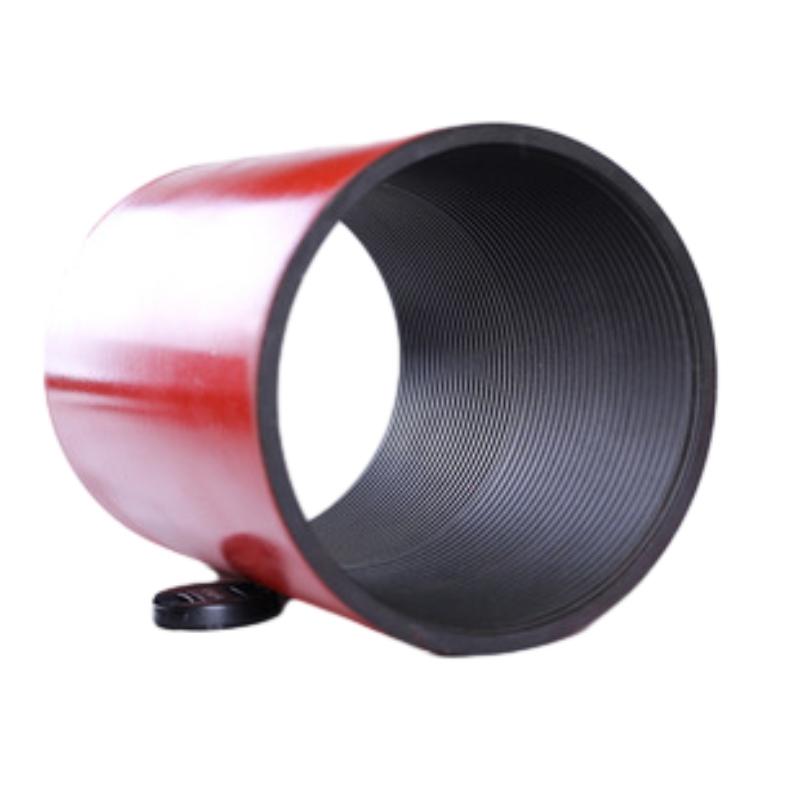

5 16 union coupling

Understanding the Dynamics of the 5% 2016 Union Coupling

The concept of union coupling represents a significant breakthrough in the realm of financial and economic analysis, particularly in understanding the ways different entities, be they nations, corporations, or even financial instruments, interlink and affect one another. Specifically speaking, the 5% 2016 Union Coupling serves as a case study exemplifying how financial instruments operate within an interconnected global economy, and the implications this has on both investors and policymakers.

At its core, the 5% 2016 Union Coupling refers to a type of financial product that can yield a return of 5% based on certain unions or collaborations formed among various stakeholders. This type of coupling is particularly relevant in the context of joint ventures, partnerships, and collaborative agreements that amplify economic potential through shared resources, knowledge, and expertise. In 2016, we witnessed a notable transformation in the global landscape, prompting a wave of collaborations across sectors in hopes of maximizing profit and efficiency.

Understanding the Dynamics of the 5% 2016 Union Coupling

The 5% return expectation reflects not merely financial gain but a broader economic strategy aimed at resilience through cooperation. In a landscape fraught with uncertainties—triggered by geopolitical tensions, technological advancements, and shifting market demands—the need for unity among stakeholders becomes critical. The coupling thus symbolizes an economic philosophy that through collaboration, entities can achieve stability and growth that would be unattainable in isolation.

5 16 union coupling

Moreover, the Union Coupling presents advantages beyond direct financial gain. It fosters innovation through shared talent and resources. Consider, for example, multinational corporations entering joint ventures with startups; they bring foundational knowledge and substantial funding, while the startups introduce cutting-edge technology and fresh perspectives. This symbiotic relationship allows both parties to thrive in ways they could not alone, emphasizing the importance of connecting distinct sectors, industries, and countries.

However, pursuing the 5% return through union coupling isn’t devoid of challenges. Disparate corporate cultures, regulatory hurdles, and differences in strategic objectives can pose risks that may jeopardize these alliances. The need for robust frameworks to navigate such complexities is therefore paramount. Legal agreements, a transparent communication strategy, and alignment of goals are fundamental to heightening the chances of a successful partnership.

The implications of the 5% 2016 Union Coupling extend beyond the immediate returns and partnerships—they frame a narrative for future economic interactions. In a world where rapid changes in technology and public sentiment can disrupt markets almost overnight, the importance of adaptive, collaborative approaches cannot be overstated. The retrospective insights from the 2016 coupling initiative can serve as a lesson for both budding entrepreneurs and seasoned investors on the significance of flexibility and resilience.

Additionally, the rise of digital platforms and blockchain technology supports the concept of union coupling by lowering entry barriers for smaller firms while facilitating seamless interactions between partners, further democratizing collaboration across industries. In this context, the idea of a decentralized yet interconnected economic system begins to crystallize, heralding a new era of collaborative commerce that seeks to overcome traditional challenges of geographical and institutional limitations.

In conclusion, the 5% 2016 Union Coupling illustrates the significance of collaborative economic endeavors in today's interconnected landscape. It symbolizes a shift towards partnership-driven profitability and innovation, highlighting the essential role of unity in driving progress amidst uncertainty. By learning from past successes and failures, stakeholders can better navigate future challenges, ultimately fostering a more resilient and vibrant global economy. As we continue to embrace collaboration across borders and industries, achieving and exceeding the expected 5% return becomes not just a financial goal, but a broader objective of sustainable growth and innovation.

-

Unlock the Benefits of Pup Joints for Your OperationsNewsOct.31,2024

-

The Quality of Casing Couplings from ChinaNewsOct.31,2024

-

The Essential Role of Pup Joints in Drilling OperationsNewsOct.31,2024

-

The Benefits of Tubing Couplings for Your ProjectsNewsOct.31,2024

-

Enhance Your Drilling Operations with Tubing Pup JointsNewsOct.31,2024

-

Elevate Your Drilling Operations with Tubing CrossoversNewsOct.31,2024